Medical Billing

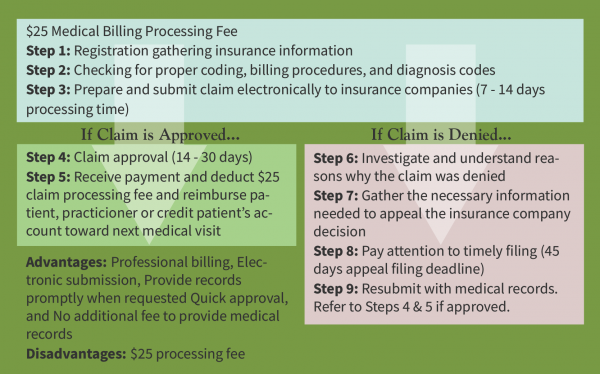

We strive to provide excellent and timely medical billing service to our patients. To continue to maintain our in house medical billing, beginning December 1st, 2018 there will be a $25.00/per claim medical processing fee for Akasha Center for Integrative Medicine LLC and de Mello Medical Corporation medical visits and services.

The fee may either be deducted from your insurance reimbursement, applied toward your next visit or pay the fee upfront. Please refer to the benefits of medical billing flow charts below.

Please review, sign and return the medical billing consent form to proceed with Akasha medical billing to email: info@akashacenter.com or fax: (310) 451-8803.

Akasha Center Medical Billing Consent Form

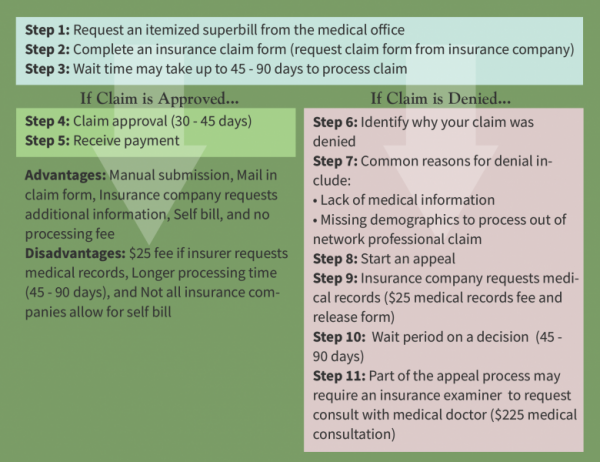

Please review the Flow-Charts below which outline both the Akasha Center Medical Billing process and the Patient Medical Self-Billing Process.

Akasha Center Medical Billing

Patient Medical Self-Billing

Common Patient Questions

1. {Q} Do I have to pay for my visit at the time of appointment?

{A} Payment for your medical care is due at the time of service. If you have medical insurance we will submit a claim on your behalf and make all reasonable efforts to obtain reimbursement from your insurance company for you.

2. {Q} What happens if my insurance carrier does not pay?

{A} Health care insurance is intended to cover some, but not all of the cost of medical care. If you have questions about your coverage its best you call your insurance company to clarify the terms of your current policy.

3. {Q} What is the difference between copayment and coinsurance?

{A} A copayment is a set fee and coinsurance is a certain percentage of a service cost once you meet your deductible.Example: if your visit is $100.00 and you have an 80/20 coinsurance plan you will pay $20.00 and insurance will pay $80.00

4. {Q} What is the difference between deductible and coinsurance?

{A} A deductible is a fixed amount you pay out-of-pocket each year before your insurance provider begins to cover any medical costs. Example: You have a doctor visit cost $325.00 you have not met your deductible you are responsible for the total charges submitted by the practitioner.

Coinsurance is a health care cost sharing between you and your insurance provider where you and your insurance provider pay a percentage of the cost of your care. A deductible can end but coinsurance goes on until you reach your out-of-pocket maximum.

If you have any questions, please contact our Medical Biller.